System Upgrade

We’re always looking for ways to serve you better – today and for years to come.

As part of our Noble Forward initiative, we have upgraded the technology that powers your accounts to make your banking experience even more secure and efficient.

You can also find the latest updates on this page at any time.

What’s Changed?

You may see some changes, including your member ownership, account numbers, and viewing joint accounts. The video below provides an overview.

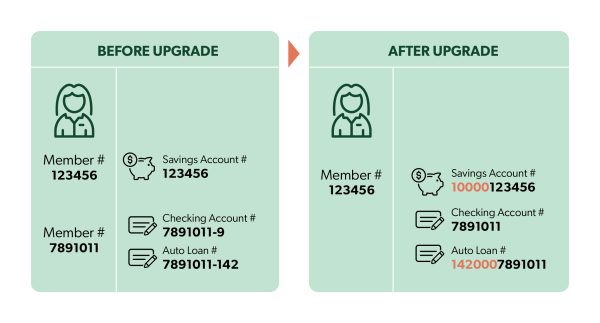

Account numbers

If you previously had multiple memberships, your account has been consolidated into the lowest membership number, as seen in the example below. For any accounts that were not originally under that lowest membership number, you must re-establish bill payments and transfer settings. We recommend logging into online banking with your new membership number to verify your account numbers and ensure your bill payments and recurring transfers are set up correctly to avoid disruption.

Please note: after the system upgrade, you will need to create online/mobile banking login credentials with your new primary member number if you haven’t already done so.

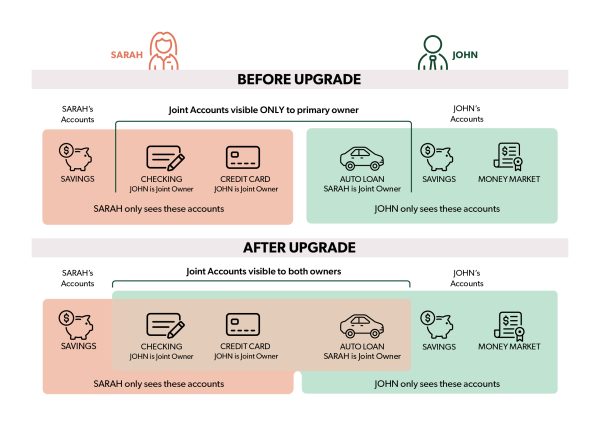

Viewing Joint Accounts

Accounts are structured differently in online banking to give you a more complete view of your financial picture. You can see all accounts associated with your Social Security/Tax ID number. This means you can see all accounts for which you are the primary accountholder, joint accountholder, trustee, Power of Attorney, and more.

PLEASE NOTE:

- If were not a joint accountholder on an account that you could see previously, you will not be able to view or access the account after the system upgrade.

- Joint members have received new member numbers that they can use to register for online/mobile banking. You received your new member number via mail or email.

If you would like to change the joint accountholder on your accounts(s), visit a branch. Signatures from all owners are required to make ownership changes.

Statements

- Statements will be generated based on the Primary account holder’s Tax ID number.

- For joint memberships, you’ll receive separate statements for unique Primary/Joint account relationship to ensure clarity and accuracy.

Self-Service Payments

Starting July 31, making payments via the Make a Loan Payment feature will be unavailable until further notice.

What Stayed the Same?

Many things you use on a daily basis have been unchanged. You’ll be happy to know these items have remained the same:

- Noble Credit Union’s routing number — 321172510

- PINs for debit cards and credit cards

- Debit and credit cards will not be reissued; card number will remain the same

- Online banking username and password will remain for those who are the primary member on an account

- Direct deposits, government-issued benefits, automatic payments (ACH)

- Scheduled payments, external transfers or payments from other financial institutions to Noble Credit Union loans or credit cards

- Checks: you can keep using your current checks as normal, even though your membership number may change, your account numbers will stay the same

System Upgrade Resources

We’re making it easy to stay informed and feel confident about the recent changes.

System Upgrade Guide

A printable overview of what’s changed. Great for reviewing at your convenience or sharing with household members. You also received a printed copy by mail.

System Upgrade Checklist

A simple step-by-step list to help you prepare—from scheduling bill payments to updating your contact info.

Frequently Asked Questions

We’ve upgraded to provide you with a more reliable and streamlined banking experience. This new system lays the foundation for future enhancements – giving you better tools, faster service, and more control over your finances.

Yes. All electronic transactions and scheduled transfers – whether incoming or outgoing – scheduled during the system upgrade (starting at 3 p.m. on July 31) did not process or post until Monday, August 4.

No.

Your account numbers now start with the individual account number (savings, auto loans, etc.), followed by a series of zeros, then your membership number.

For example:

Savings: 1 + zeros + 1234 -> 1000001234

Auto loan: 142 + zeros + 1234 -> 1420001234

If you had one membership number, that number did not change. If you had more than one membership on which you were the Primary member, all of the accounts in each of those memberships was consolidated into the lowest membership number.

For example, if you had membership number 1234 and 56778, member number 5678 was consolidated into 1234, the prevailing membership number.

If you had multiple memberships that were consolidated into the prevailing membership, you will need to use that prevailing member number to register for online and mobile banking (as noted above). If you had only one membership number previously, then your login credentials have not changed.

As the joint on a membership, we encourage you to create your own username and password with your new membership number to ensure the Primary member’s information remains private and secure. You received your new member number via email or mail prior to the system upgrade.

If your accounts were consolidated into one membership, you may need to re-establish transfers and payments. We recommend logging into online or mobile banking to check.

If you’ve linked your Noble checking account to your transfer programs using the prevailing membership number, no update is needed. These links should continue to work, but it is a good idea to test with a small transfer to make sure everything is functioning correctly.

All of your memberships have been consolidated under a single membership (the one with the lowest number).

Your online banking experience has remained largely the same, and your accounts are now clearly organized, so you can manage your finances in one convenient place. This streamlined view is part of our effort to improve your digital banking experience.

We’re happy to help. To better serve you, you can make an appointment at NobleCU.com to speak with a branch representative.

Stay Informed

Ensure your email address is up to date by visiting Settings in online banking or the mobile app.